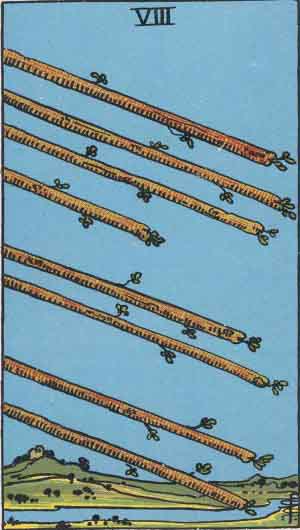

Ten of Wands

TEN OF WANDS

The Ten of Wands represents a situation that started off as a good idea but has now become a burden. It signifies problems, responsibilities, being overburdened, overloaded, and stressed. In the context of money, this card suggests that you may have taken on too much financial responsibility or debt, and it is now weighing heavily on you. It indicates that you are feeling overwhelmed and restricted by your financial obligations.

Strive for Balance and Delegate

The Ten of Wands in the position of advice urges you to strive for balance in your financial life. It is important to recognize that you cannot carry the entire burden on your own. Delegate tasks and responsibilities to others who can help lighten the load. Consider seeking professional financial advice to help you restructure your debt and create a more manageable financial plan.

Reevaluate Your Financial Commitments

This card serves as a reminder for you to reevaluate your financial commitments. Take a step back and assess whether you have taken on too much or if there are any unnecessary expenses that can be eliminated. It may be necessary to make some tough decisions and let go of certain financial obligations that are causing you stress and preventing you from achieving financial stability.

Seek Support and Collaboration

The Ten of Wands advises you to seek support and collaboration in your financial journey. Reach out to trusted friends, family members, or financial professionals who can provide guidance and assistance. By sharing the burden with others, you can alleviate some of the stress and find new perspectives and solutions to your financial challenges.

Prioritize Self-Care and Well-being

Amidst the financial burdens and responsibilities, it is crucial to prioritize self-care and well-being. Take time to rest, recharge, and engage in activities that bring you joy and relaxation. By nurturing yourself, you will be better equipped to handle the challenges and make sound financial decisions. Remember that your well-being should not be sacrificed for the sake of financial obligations.

Create a Realistic Financial Plan

The Ten of Wands advises you to create a realistic financial plan that takes into account your current situation and limitations. Assess your income, expenses, and debts, and develop a budget that allows for both financial stability and personal enjoyment. Set achievable goals and milestones to track your progress. With a well-thought-out plan, you can gradually lighten the burden and regain control over your financial situation.

Explore All Tarot Cards